Manage multiple accounts

Connect as many bank accounts as you want in one interface or create a virtual family or child account.

Seamlessly integrate or deploy your own mobile app with banking features your customers will love. Discover additional growth opportunities for your business based on customers' shopping behaviour.

What makes a good API really good? Working with us opens the door to over 250+ banks in Europe with a seamless and effortless onboarding process.

Since we only act as an intermediary for the white label services, we can easily integrate them as micro-services into your existing mobile applications, websites, core software systems and other digital assets.

We are an aggregator of bank API connections. As our partner, you have full control over your end customers' valuable data. We help you comply with all regulatory requirements.

No matter how specific your questions or how complex your problem, we have the talent and experience to solve it effectively.

Connect as many bank accounts as you want in one interface or create a virtual family or child account.

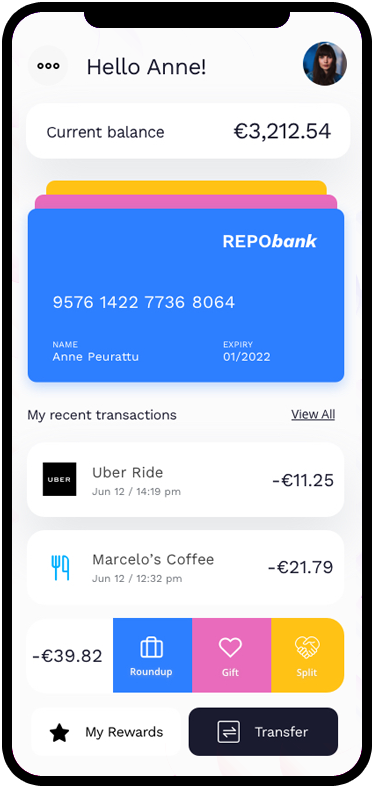

Manage and distribute your own virtual and physical cards. Configure programs exactly as you want.

Allow your customers to make one-time charges or set up orders for recurring payments.

Enhance existing loyalty solutions and seamlesly reward your customers as they shop.

Initiate payments through connected IoT devices such as smart watches or NFC enabled wearables.

We offer an eIDAS compliant solution for video and electronic customer identification and verification, as well as PSD2 (SCA) and GDPR solutions.

We do. Based on your specific needs, we can integrate both features that range from basic to customised, as well as connect with your core software systems. Just choose the specific features you need and we’ll make sure you deliver a unique experience to your customers across all platforms.

We are an aggregator of bank API connections, our solutions are designed to meet current industry standards and ensure regulatory compliance and security. We provide both security solutions for your customers and compliance for your institution in terms of GDPR, PSD2, eIDAS and other.

We’re available for both iOS and Android. Our platform is highly flexible in terms of UX, so your customers always enjoy a high quality experience.

Customise to your needs and launch in as little as 2 months. We know that developing your own mobile banking app is not trivial. We have experienced it! The process is time-consuming and complicated, resources are often limited and commitment is high. That's why we have identified the most common needs of various non-financial institutions and developed a white-label solution that dramatically reduces time-to-market.

We are a marketing platform that allows you to capture, study and analyse the lifestyle and shopping behaviour of your current and potential customers based on aggregated financial and bank account data. We offer a set of pre-built features to help you reach the market faster. Drive organic growth for your business by creating an omnichannel experience for your customers, entering new market segments and benefiting from new revenue streams. We can help retailers and brands dive deep into customer insights that no other technology can deliver with such precision.

It's intuitive. By that, we mean that we designed our solution to focus on the end user's perspective on data sharing and transparency. Disclaimers and terms of use should be clear and transparent. Ours are "only" 2.5 pages long. We have identified over 40 different parameters based on which combinations of rewards and benefits programs can be developed to compensate for data intelligence. All with the goal of making the service experience more personal, relevant and meaningful to people's lives (not just users!). We only want to work with partners who share our views in this regard. We stand by this principle.

We are finance and IT folks. A technology company with 12 years of experience in software development. Our main goal is to simplify the complex digital world with minimalistic interventions and great effects. Our passion is to develop services that people love. We guide you through the entire process from planning and design to implementation, deployment and compliance and even help you get funding for your digital ventures through the available EU funding programmes. Our experienced team ensures that the final product meets your requirements and can be deployed and used by your customers in a timely manner.

Amazing. The best way to get started is to discuss your needs and ideas with us so we can recommend the best way forward. Take a look below and drop us an email. Our team will get back to you as soon as possible.

We can now accurately estimate the costs of addressing each reason your customers choose a competitor over you and weigh those costs against your potential financial return in each case to advance beyond incremental efficiencies.

Measures of satisfaction and loyalty in themselves can’t tell you how your customers will divide their spending among you and your competitors. SOW can! Customer Loyalty Isn’t Enough. Grow Your Share of Wallet!

Access to personal financial data can now help non-financial businesses develop and deliver better and more efficient product / service to customers. It can help improve business in terms of personalisation, content relevance and boost engagement.

Number of users in 9 countries.

Total processed transactions.

Daily transaction value.